oregon tax payment system

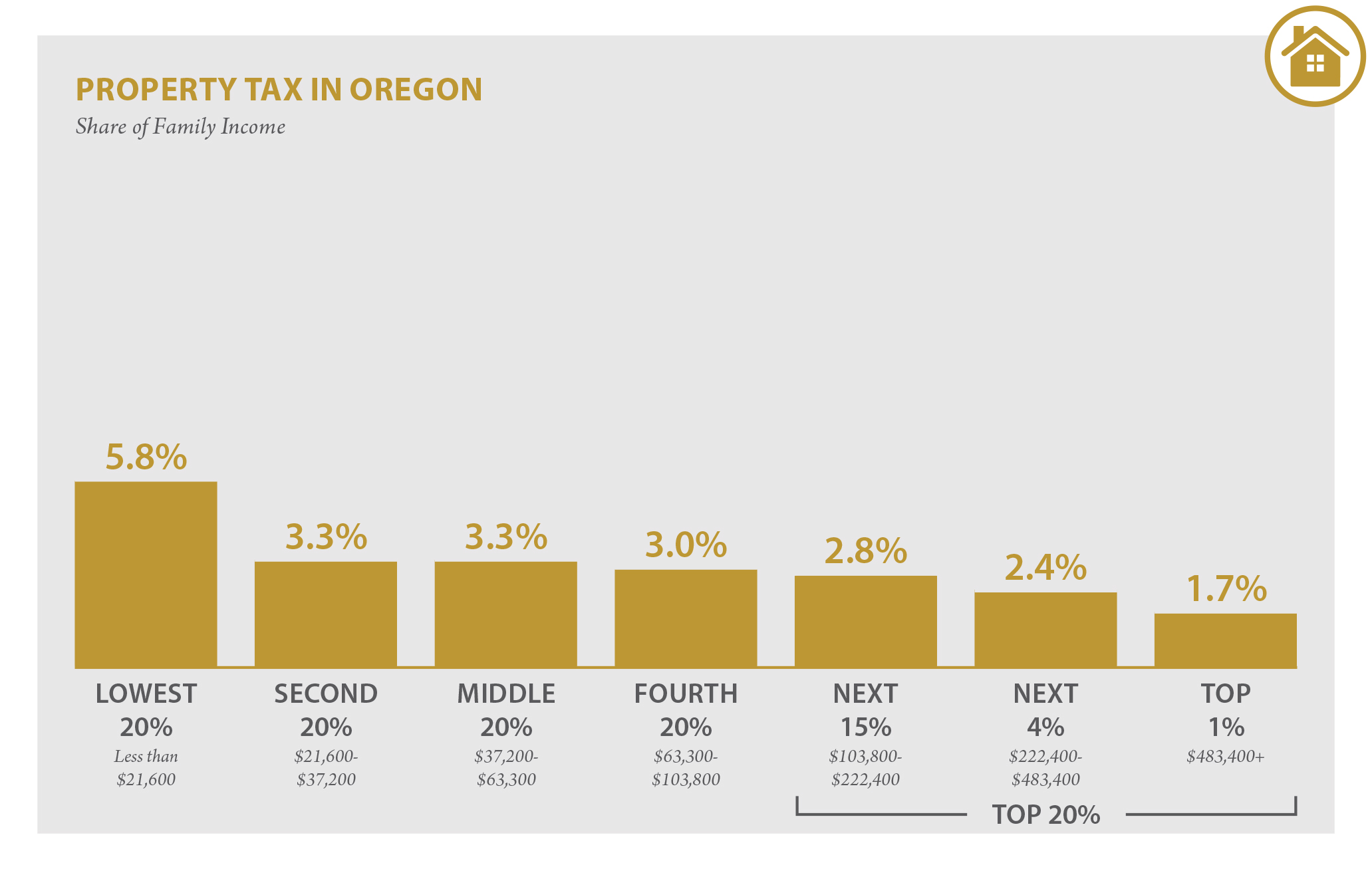

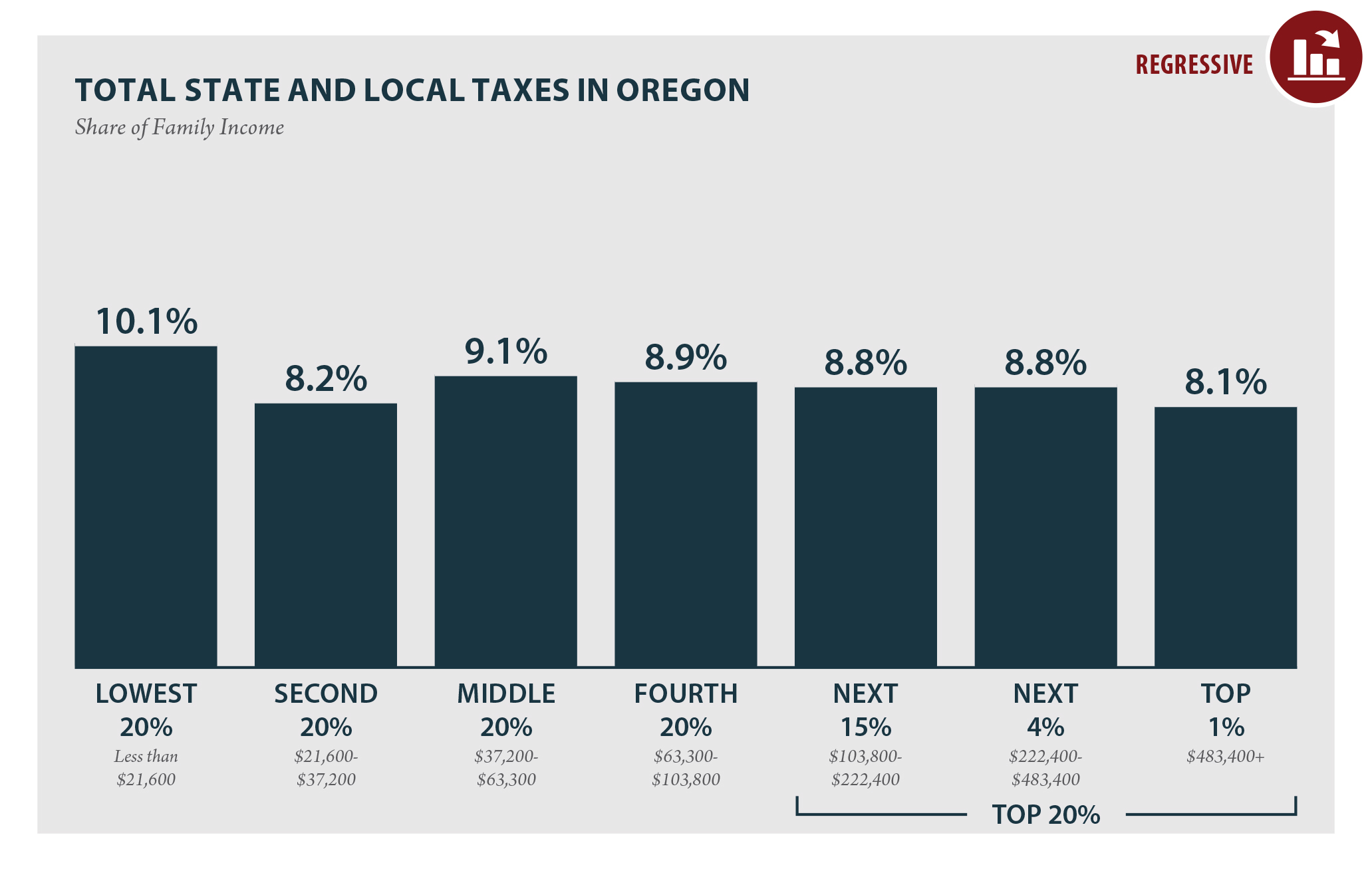

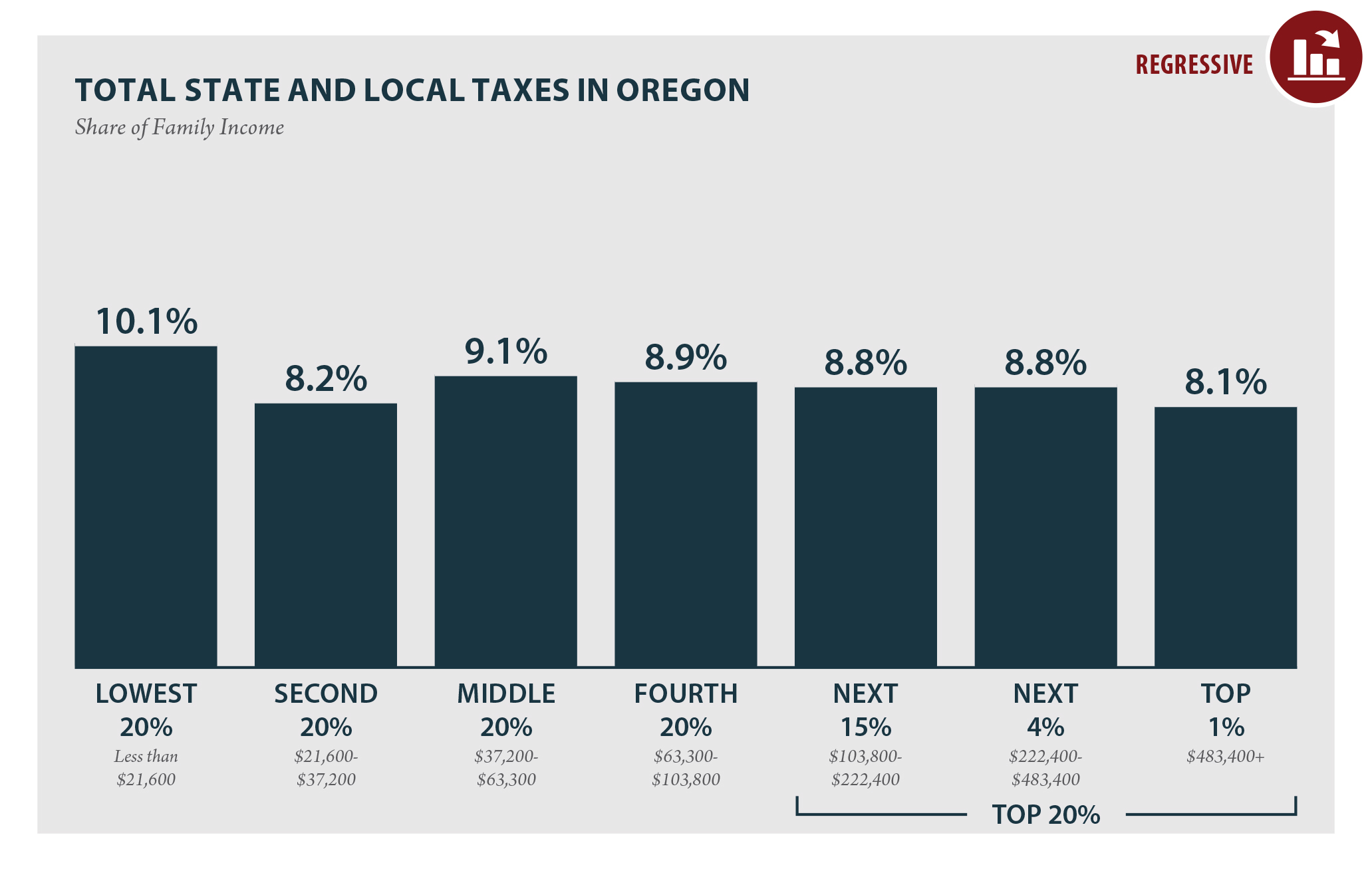

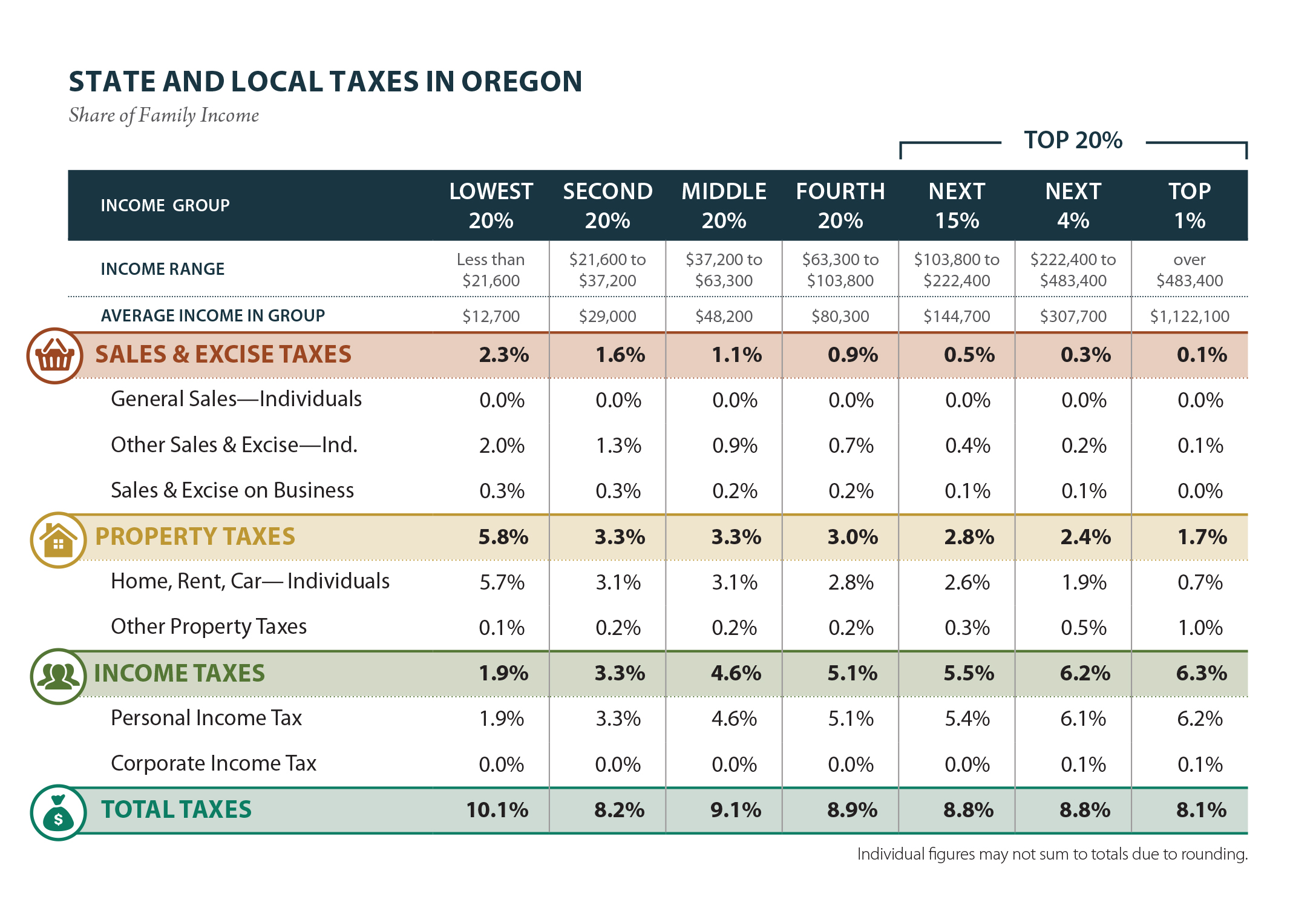

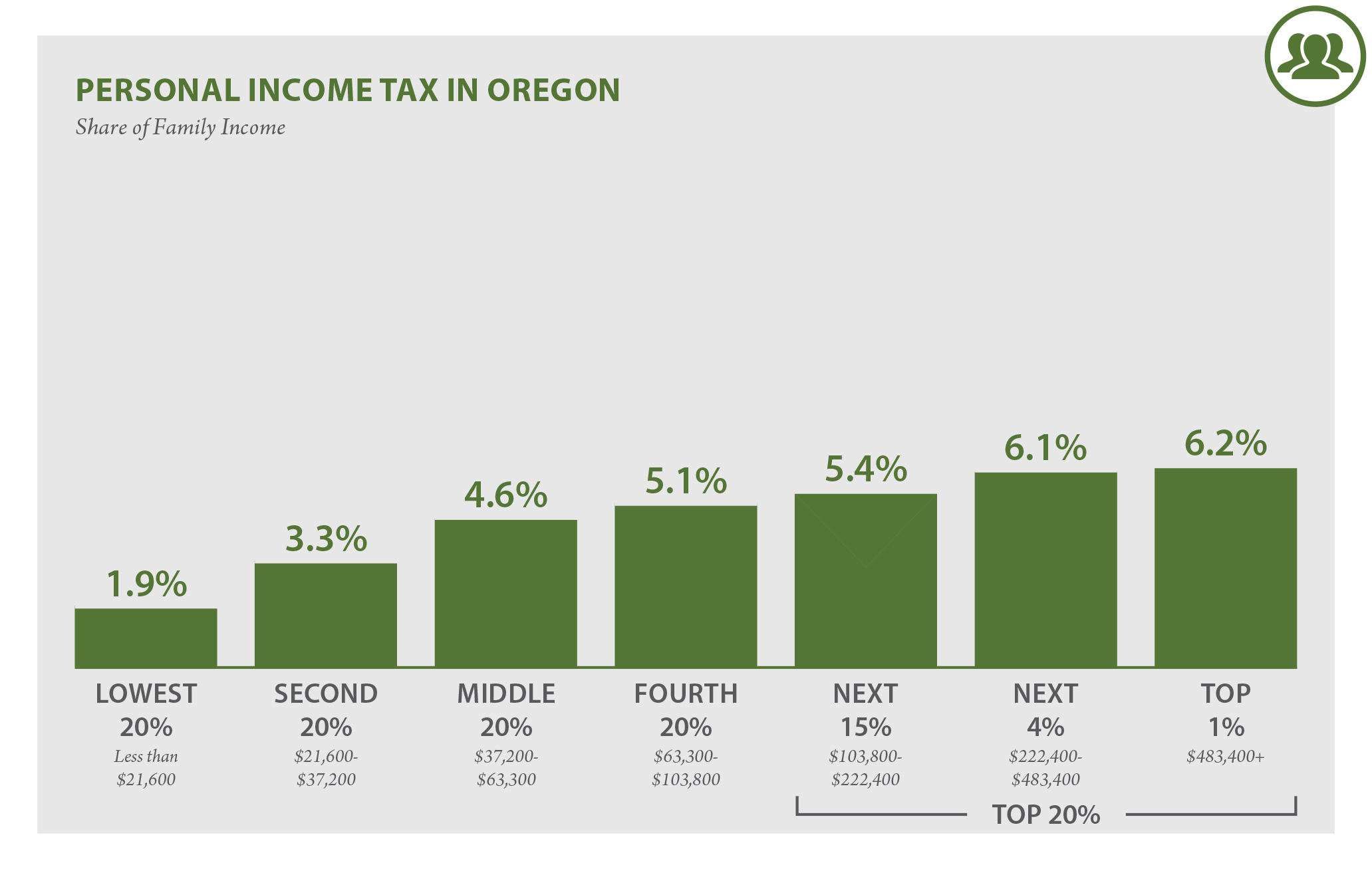

EFT Questions and Answers. Oregons personal income tax is mildly progressive.

Gop Tax Bill Win A Big Loss For Berea College College Berea College Berea Open Source Code

Oregon Tax Payment System Oregon Department of Revenue.

. Free tax preparation services Learn more. If you are a first time user of the. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online. Pay the Full Payment amount on or before November 15 and receive a 3 discount on the current years tax amount. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation.

Skip to the main content of the page. Your browser appears to have cookies disabled. File your tax return anyway to avoid penalties.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. Payment is coordinated through your financial institution and they may charge a fee for this service. You have been successfully logged out.

Cookies are required to use this site. EFT Questions and Answers. 10 of unpaid tax liability.

Be advised that this payment application has been recently updated. Please contact the Oregon. If you are already registered sign in to update your account file your tax reports andor pay any balance due.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation. You may now close this window. From Jesus to Adam Smith there is wide agreement that a fair tax system is one based on the.

Even if youre unable to pay the entire tax bill you should. The entire tax system is not. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes.

A Oregongov account allows you to access all of your Oregongov online services in one place. Mail a check or money order. General Oregon payroll tax rate information.

Welcome to the Oregon Fuels Tax System. Be advised that this payment application has been recently updated. It is not a payment system.

Payments can be made using the Department of Revenues site Revenue Online httpsrevenueonlinedororegongovtap_. EPayroll for transferring or separating employees. While the federal minimum wage is now 725 per hour Oregons minimum pay is substantially higher and can vary greatly depending on the location or city.

PENALTIES AND INTEREST FOR LATE PAYMENTS. Instructions for personal income and business tax tax forms payment options and tax account look up. Everything you need to file and pay your Oregon taxes.

Frances Online will replace the Oregon Payroll Reporting System OPRS and the Employer Account Access EAA portal beginning with the third quarter filing in 2022. 2021 Tax Rates and breakdown of changes for Oregon employers. Owing money to the government can be frightening but were here to help you.

Find approved tax preparation services. On July 1 2021 the. Oregon Department of Revenue.

Signing up is easy and only takes a few minutes. Pay the two thirds payment amount on. If you transfer between agencies youll need to update your email address on your profile if you are using your work email address.

OPRS is a reporting system only. 10 of unpaid tax liability. If you use a.

If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. Oregon Tax Payment System Oregon Department of Revenue. UI Trust Fund and Payroll Taxes FAQ.

Oregon Judicial Department Tax Court Opinions Tax Court Opinions State Of Oregon

![]()

Oregon Judicial Department Ojd Courts Epay Online Services State Of Oregon

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

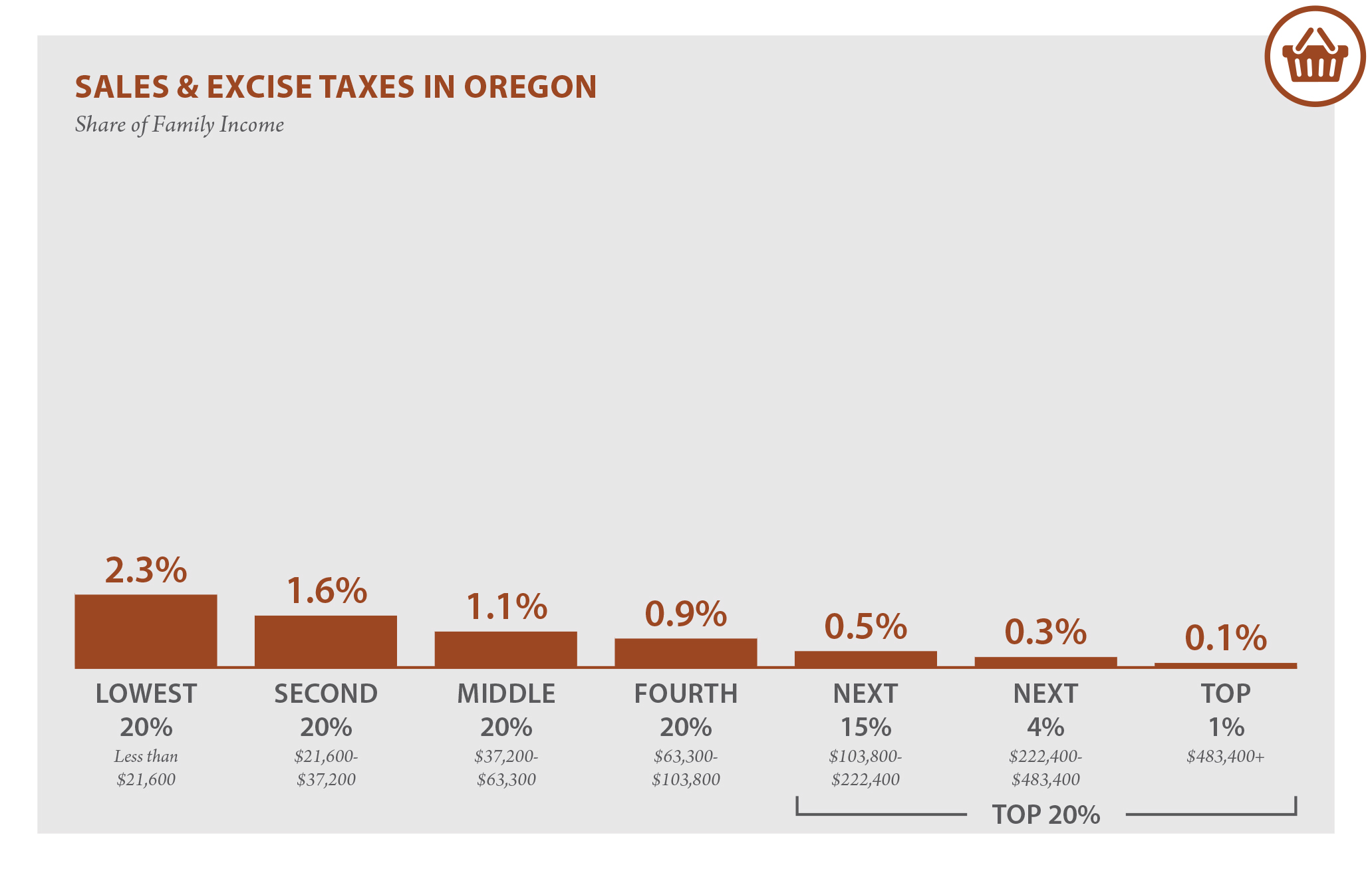

Oregon Who Pays 6th Edition Itep

Oregon Who Pays 6th Edition Itep

State Of Oregon Blue Book Government Finance State Government

Where S My Oregon State Tax Refund Taxact Blog

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Who Pays 6th Edition Itep

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

State Of Oregon Blue Book Government Finance Taxes

Oregon Bottle Deposit Value To Double In April 2017 Soda Tax Bottle Beer Bottle

Oregon Who Pays 6th Edition Itep

State Of Oregon Oregon Department Of Revenue Payments